Detailsīudget FY 2017 - Economic Assumptions FY 1976 - FY 2017Įconomic Assumptions FY 1976- FY 2017 documents.

#2017 us government budget pdf#

PDF Detailsīudget FY 2017 - Balances of Budget Authorityīalances of Authority documents. PDF Detailsīudget FY 2017 - Federal Credit Supplementįederal Credit Supplement documents. Additionally, Table 1.1 provides data on receipts, outlays, and surpluses or deficits for 1901-1939 and for earlier multiyear periods.

#2017 us government budget series#

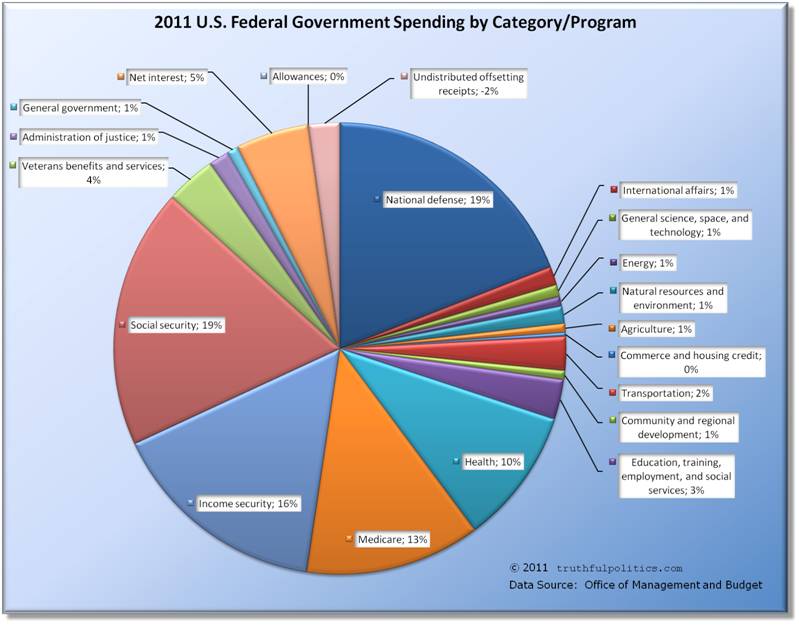

Many of the data series begin in 1940 and include estimates of the President's Budget for 2016-2021. Historical Tables provides a wide range of data on Federal Government finances. It includes for each agency: the proposed text of appropriations language budget schedules for each account legislative proposals explanations of the work to be performed and the funds needed and proposed general provisions applicable to the appropriations of entire agencies or group of agencies. The Appendix contains financial information on individual programs and appropriation accounts. The Appendix contains detailed information on the various appropriations and funds that constitute the budget. The Analytical Perspectives volume also contains supplemental materials with several detailed tables, including tables showing the budget by agency and account and by function, subfunction, and program, that are available online and as a CD-ROM in the printed document. This volume includes economic and accounting analyses information on Federal receipts and collections analyses of Federal spending information on Federal borrowing and debt baseline or current services estimates and other technical presentations. PDF DetailsĪnalytical Perspectives contains analyses that are designed to highlight specified subject areas or provide other significant presentations of budget data that place the budget in perspective. The primary Budget volume is the main overview of the FY 2017 Budget of the President and contains the Budget Message of the President, information on the President's priorities, budget overviews by agency, and summary tables. President Donald Trump is set to reveal his plan for tax reform Wednesday, which experts say will largely benefit corporations and the wealthy, cutting the top individual income-tax rate from 39.6 to 35 percent and potentially creating loopholes for businesses, reports CNBC.Įxperts expect tax reform to add to the deficit, especially since the president's proposed discretionary budget for 2017 increases spending in some areas, such as on the military.Budget FY 2017 - Budget of the U.S. At some point, you've got to say, 'Enough is enough!' and make the hard cuts necessary to win over the long haul," he writes. "You can't borrow your way out of debt, whether you're a typical American family or the entire U.S. That's why Dave Ramsey believes America should try to balance its budget. Still, interest on America's debt makes up a significant chunk of its annual budget: 6 percent, or $229 billion a year, which is about $200 billion more than America spends on science (1 percent, or under $30 billion) or energy and the environment (1 percent, or about $45 billion). Unlike an individual in the red, a country is often right to keep spending, and is often rewarded for doing so. As she writes in the Guardian, balancing a nation's budget shouldn't be a high priority for much the same reason that austerity doesn't help nurse nations back to financial health. Personal finance author Helaine Olen agrees. The United States, says one expert, simply won't do that." "After all, they can miss credit card payments once in a while without tanking the economy. No American household has that kind of leeway," reports U.S. plenty more ability to borrow, but to do it at remarkably low rates. "Even with ever-growing debt (and one downgrade), markets are still more than fine not only with giving the U.S. A country, for example, can handle a deficit more comfortably than a family can, some experts argue. There are many good reasons to think of a nation's budget differently than a household's. If the average family spent an equivalent percentage on food, it would dine out, and order in, on only $1,140 a year. Another 2 percent goes to transportation, while 4 percent goes to agriculture and food. A scant 2 percent of the country's budget goes to housing, for example. If the average family spent an equivalent percentage on defense, it would be dropping over $9,000 each year.Īmerica as a whole has different priorities than the families living within it.

About three-quarters of the nation's spending went to three big-ticket items: the military (16 percent), health care (27 percent) and social security, unemployment payments and other labor costs (33 percent).

0 kommentar(er)

0 kommentar(er)